Cryptocurrency

Exodus is a hot wallet, which means it’s a software wallet that’s connected to the internet. But it’s noncustodial, which means that only you have access to your private key — a 12-word password phrase that protects access to your crypto assets https://las-atlantis.org/.

For example, if you’re trying to safeguard against online hacking, it may make sense to go with a hardware wallet, particularly if you don’t intend to transact with your crypto. But it exposes you to other risks: losing your keys if they’re written down or the loss or theft of the physical device.

Yes, you need a crypto wallet to securely store your digital assets. Wallets protect your secret keys, giving you control over your crypto, and the only way to access them is with a unique key. Without a wallet, you risk losing your digital assets forever.

It’s important to note that Ledger suffered a data breach in July 2020 that resulted in the theft of some customers’ personal data — but, significantly, not their crypto assets. No private keys to wallets were taken, but there were reports of customers receiving phishing emails and other scamming threats afterward. That noted, Ledger has long been a trusted name in the crypto world, but the data breach is a good reminder to be careful online — especially when it comes to dealing in crypto assets.

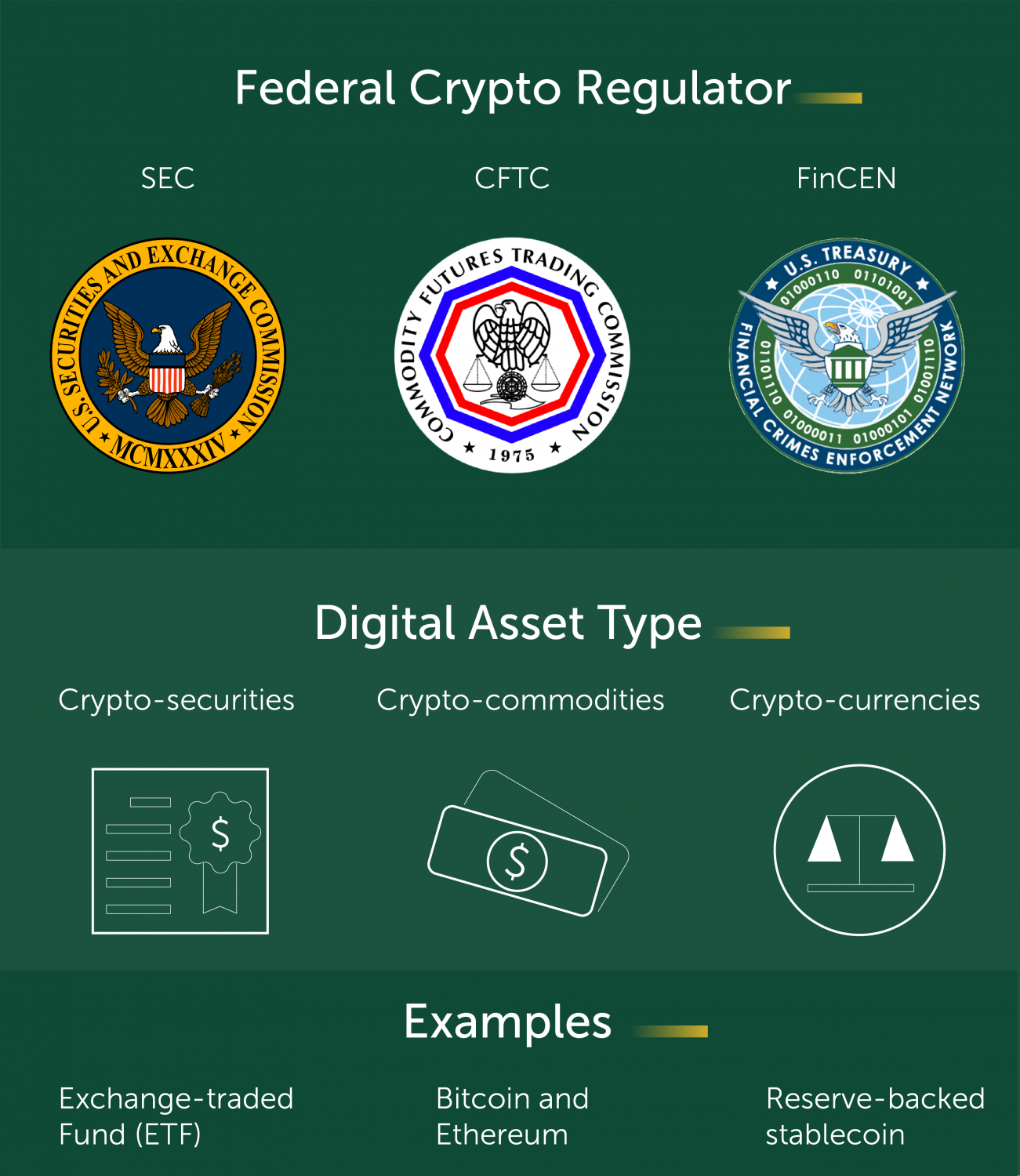

Cryptocurrency regulation sec

For some time, cryptocurrency has been seen as a tool for diversification, but the tea leaves are starting to read differently. Earlier this year, the International Monetary Fund (IMF) released data indicating a correlation between bitcoin and the S&P 500. This raises fears of spillovers of investor sentiment between the stock market and cryptocurrencies.

For example, suppose you invest in a real estate investment trust (REIT), which pools money to buy, manage, and sell real estate. The REIT is managed by a team of real estate professionals, the third party under the Howey test. It decides which properties to buy, how to manage, and when to sell them. Your expectation of a profit largely depends on the real estate expertise and the efforts of this management team. The REIT meets the Howey test criteria because 1) you invested money, 2) your investment is in a common enterprise (the REIT), 3) you set out to profit, and 4) the third party does the work.

SEC Chair Gary Gensler has made clear he believes the vast majority of cryptocurrencies are securities, based on the Howey Test, which comes from a 1946 Supreme Court ruling in the SEC v. W.J. Howey Co.

For some time, cryptocurrency has been seen as a tool for diversification, but the tea leaves are starting to read differently. Earlier this year, the International Monetary Fund (IMF) released data indicating a correlation between bitcoin and the S&P 500. This raises fears of spillovers of investor sentiment between the stock market and cryptocurrencies.

For example, suppose you invest in a real estate investment trust (REIT), which pools money to buy, manage, and sell real estate. The REIT is managed by a team of real estate professionals, the third party under the Howey test. It decides which properties to buy, how to manage, and when to sell them. Your expectation of a profit largely depends on the real estate expertise and the efforts of this management team. The REIT meets the Howey test criteria because 1) you invested money, 2) your investment is in a common enterprise (the REIT), 3) you set out to profit, and 4) the third party does the work.

Cryptocurrency exchange

Writers and editors and produce editorial content with the objective to provide accurate and unbiased information. A separate team is responsible for placing paid links and advertisements, creating a firewall between our affiliate partners and our editorial team. Our editorial team does not receive direct compensation from advertisers.

Play-to-earn (P2E) games, also known as GameFi, has emerged as an extremely popular category in the crypto space. It combines non-fungible tokens (NFT), in-game crypto tokens, decentralized finance (DeFi) elements and sometimes even metaverse applications. Players have an opportunity to generate revenue by giving their time (and sometimes capital) and playing these games.

Centralized exchanges offer convenience, while decentralized exchanges provide increased privacy and control over funds. They differ in that centralized exchanges are operated by a single entity, while the responsibility for trades is distributed among network participants in a decentralized exchange.

Coinbase is one of the most prominent names in the crypto space. Launching in 2012, it offers an intuitive, beginner-friendly platform to buy, sell, exchange and store cryptocurrencies. It also offers a straightforward onboarding process, making it easy for newcomers to start trading. Moreover, the platform’s extensive educational resources and tutorials help users understand the crypto market and make informed decisions. It’ll even give you some crypto to learn about crypto. With a wide variety of coins available and reliable, accessible customer support, Coinbase is a comprehensive, beginner-friendly solution for entering the world of crypto trading.